DMO Lists N10.69bn FGN Sovereign Green Bond on NSE

The Nigerian Stock Exchange (NSE) is pleased to announce the listing of the N10.69billion, 5-year, Federal Government Sovereign Green Bond at coupon rate of 13.48% on the Exchnage by Debt Management Office (DMO) on Friday, July 20, 2018. On the same day, the NSE also held a pre-listing conference for market participants, themed, ‘Exploring the Green Financing Opportunity: Green Bonds and Enabling Frameworks’ to highlight the opportunities available within the Green Bond market in Nigeria.

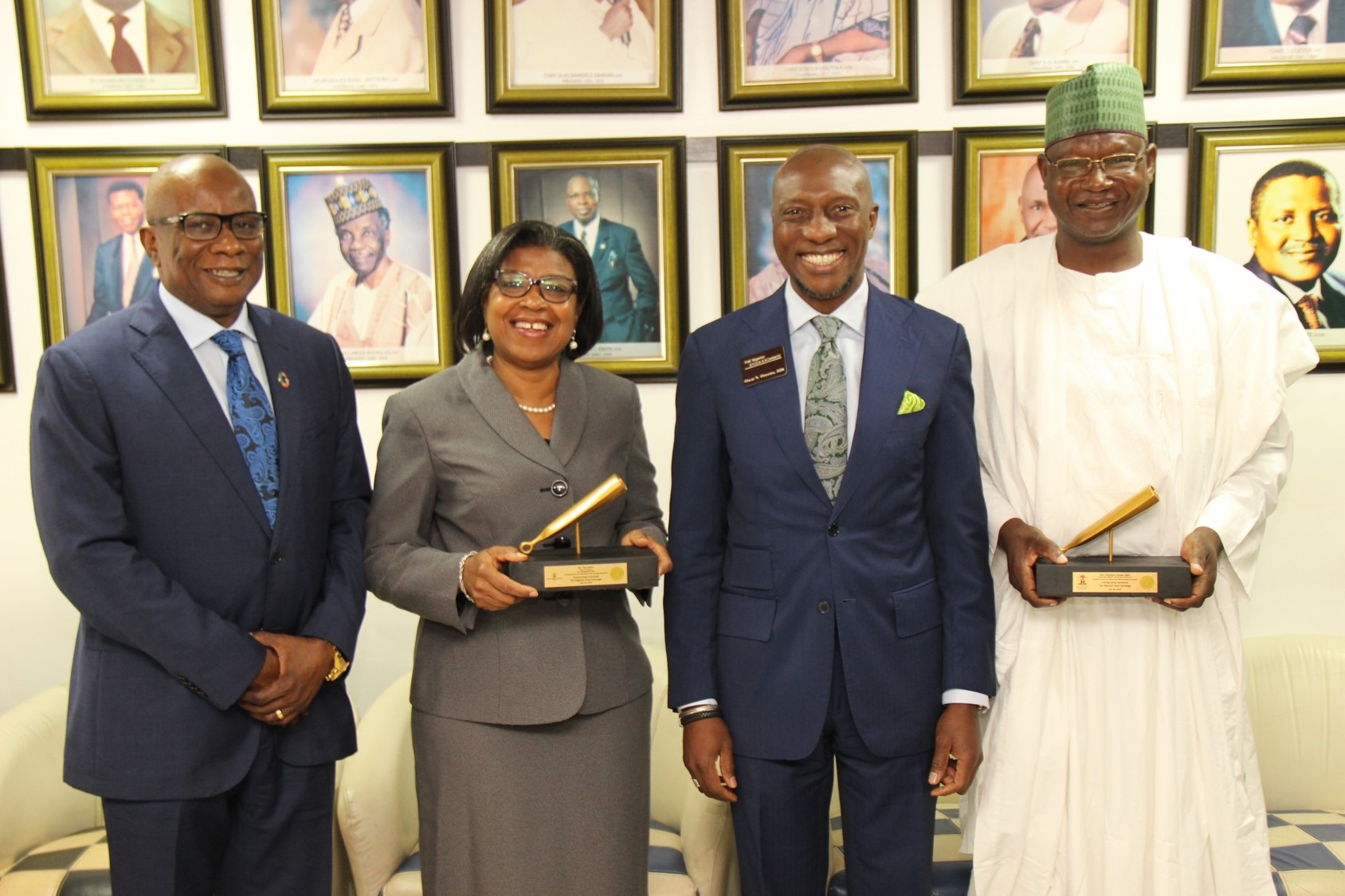

The event had in attendance about 200 market operators, government officials, c-level executives, as well as top officials from the academic and sustainability sector. The event was headlined by Ms. Pat Oniha, DG, DMO, Hon. Ibrahim Usman Jibril, the Honourable Minister of State for Environment, and Ms. Amina J. Mohammed, United Nations Deputy Secretary General, represented by Mr. Edward Kallon, UN Resident/Humanitarian Coordinator and UNDP Resident Representative.

The Sovereign Green Bond is part of a strategic process by the Federal Government to add to the nation’s funding options to catalyse the rebound of the economy and offer the vast majority of Nigerians, a new alternative. The listing of this Sovereign Green Bond, which is the country’s first ever certified green bond and the first in an emerging market, is a testament to NSE’s continued vision of pushing green finance and more broadly, the sustainable development agenda in Nigeria.

Commenting on the listing, the Chief Executive Officer of The Nigerian Stock Exchange, Mr. Oscar N. Onyema OON said, “Admitting the first ever sovereign green bond in an emerging market is yet another milestone for the Exchange and is a further affirmation of our unique platform to support both the Federal Government and businesses to access capital for sustainable initiatives. The listing of the FGN Green Bond represents a new stage in the development of Nigerian capital markets and opens the way for further corporate issuance and international investments. As a member of the UN Sustainable Stock Exchange Initiative, we are committed to developing this enormous opportunity for Nigeria.”

In her statement during the listing ceremony, the Director General of DMO, Mrs. Patience Oniha, stated that, “The Green Bond Listing is an opportunity to enable Nigeria tap into the growing global market for green bonds, which as of end of 2016 comprised of $576billion of unlabeled climate-aligned bonds and $118billion of labelled green bonds according to Climate Bonds Initiative in London. The DMO is proud to list the N10.69 billion FGN Green Bond 2022 on the NSE and expects that trading this instrument will not only bring about Climate Change Awareness but will also diversify the Nigerian Capital Market and attract more investors”.

According to the Honourable Minister of State for Environment, Hon. Ibrahim Usman Jibril, “The Sovereign Green Bond further reinforces Nigeria’s reemergence as a major player in the international climate regime, and President Muhammadu Buhari’s strides in moving Nigeria towards being a low-carbon economy. The issuance of a Green Bond by Nigeria delivers on program 47 of its Economic Recovery and Growth Plan (ERGP), in addition to meeting the expectations set out in Article 2 of the Paris Agreement. This places progress on the NDCs targets in sight and lays the foundation for the expansion of the Federal Government’s Green Bond Issuance Program on a recurring basis.”

The Green Bond issuance and listing follows Nigeria’s endorsement of the Paris Agreement on Climate Change on September 21, 2016. The Paris Agreement aims to strengthen the global response to the threat of Climate Change. Since the signing of the Agreement, various countries that are parties to the Agreement have initiated several steps aimed at making the environment better.

It will be recalled that, NSE, in collaboration with Federal Ministry Environment, Federal Ministry of Finance and Debt Management Office hosted a high profile conference themed “Green Bonds: Investing in Nigeria’s Sustainable Development” in 2016 that provided an opportunity for the government to engage the capital market stakeholders. The conference was a major step towards the issuance of Nigeria’s first sovereign green bond.

Parties to the transaction include The Ministry of Environment, The Debt Management Office and Chapel Hill Denham, who are the financial advisers to the transaction.

Leave a Reply