Niger Insurance Settles Claims Worth N1.4bn In Nine Months …Affirms Commitment To Prompt Settlement of Outstanding

By Ngozi Onyeakusi — Niger Insurance Plc, one of the foremost composite insurance companies in Nigeria has paid claims worth over N1.4bn to customers in the past 9months.

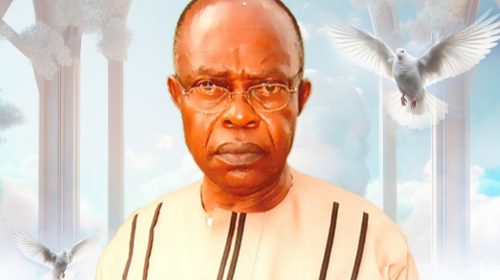

The company new MD/CEO Mr. Edwin Igbiti who made this known during media parley in Lagos,

assured the firms resolve to settle all other outstanding claims. He thanked all of its customers for their patience, trust and understanding during the challenging period in its long and otherwise stellar history while reaffirming the company’s renewed sense of responsibility and commitment to excellence.

According to him, “There is a growing sense of purpose at Niger Insurance Plc these days; it feels like a new dawn with management, staff and shareholders all working with passion and a common intent to write a great story in this new chapter of the company’s long and chequered history.

He noted that to reposition the well-known company for service excellence and competitiveness in a rapidly changing operating landscape, the company has designed a five year transformation blueprint (2020 to 2024) which focuses on operational and technological advancements in delivering bespoke Insurance solutions to businesses, institutions and the growing populace of Nigeria.

The implementation of the transformation plan, the firm said in a statement already began in the fourth quarter of 2019 following the appointment of the company’s new MD/CEO – Mr. Edwin Igbiti, a vastly experienced and well- respected business leader who recently completed five meritorious years as MD of AIICO Insurance Plc.

“The need for Niger Insurance Plc’s transformation is underscored by a combination of market & regulatory changes. Having been in operations for 57years, it had become imperative to address legacy challenges as well as innovate to achieve service excellence, agility and & competitiveness” it stated.

Igbiti further noted that the three pillars of the transformation plan are:

“1. Strengthening our balance sheet (financial strength)

2. Strengthening our People (Talent & Innovation)

3. Strengthening our business model (Sustained growth & Profitability)”.

He pointed out that in order to ensure a successful execution of this plan, the company recently reconstituted a new Board-of-Directors, a new management team and an array of strategic partnerships.

He said that at its 49th AGM which held on 21 November 2019, the company’s shareholders approved its recapitalization plan to meet the new regulatory capital requirements through (i) an equity capital raise via rights issue and/or private placement and ii) a business combination by way of merger or acquisition, which must all be completed by 30 June, 2020.

Mr. Ademola Salami, the company’s new Chief Financial Officer (CFO) while providing a progress update said “Working with our Financial Advisers, the Board and Management of the company are already engaging with foreign and local investors that have shown interest in the company. High-level negotiations are on-going and we expect to secure substantive offers for investment in the coming weeks.”

In response to the situation regarding unpaid claims & outstanding customer benefits, the MD expressed regret and attributed the delay to the company’s large asset portfolio which is skewed towards fixed assets.

He however assured the audience that the company’s assets are more than sufficient to settle all its liabilities and that it has made significant progress towards liquidating some fixed assets to unlock cash and pay down all outstanding obligations soon..

Leave a Reply