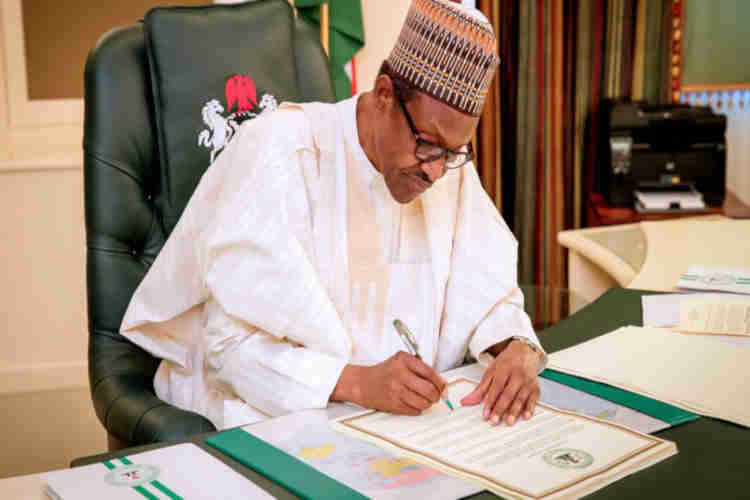

Nigerians to start paying 7.5% VAT as Buhari signs Finance Bill into law

With the signing of the Finance Bill, 2020 into law by President Muhammadu Buhari, Nigerians will begin to pay the new increment of 7.5 per cent as Value Added Tax (VAT). President Buhari assented to the bill barely a month after its passage by the National Assembly and subsequent forwarding by the legislature to the President for assent.

Recall that President Buhari, while presenting the 2020 Appropriation Bill to the National Assembly, also presented the Finance Bill. The President had explained that: “This Finance Bill has five strategic objectives, in terms of achieving incremental, but necessary, changes to our fiscal laws. “These objectives are; Promoting fiscal equity by mitigating instances of regressive taxation; Reforming domestic tax laws to align with global best practices; Introducing tax incentives for investments in infrastructure and capital markets; Supporting Micro, Small and Medium-sized businesses in line with our Ease of Doing Business Reforms; and Raising Revenues for Government.

“The draft Finance Bill proposes an increase of the VAT rate from five per cent to 7.5 per cent, as such, the 2020 Appropriation Bill is based on this new VAT rate. ” The Federal Executive Council (FEC) had on Wednesday, September 11, 2019, approved a 50% increase in the Value Added Tax (VAT) rate applicable on supply of goods and services in Nigeria, from five per cent to 7.5 per cent. The new rate according to the Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, is expected to take effect in the first quarter of 2020. In a statement by the Special Adviser to the President, Media and Publicity, Chief Femi Adesina on Monday, with the assent, there will be more revenue to finance key government projects especially in the areas of health, education and critical infrastructure. The President had earlier announced the signing of the law personally through his verified Twitter handle @MBuhari.

Vanguard

Leave a Reply