SEC expects N1.5tr growth in mutual funds by 2020

By Ngozi Onyeakusi– The Securities and Exchange Commission has expressed optimism that Collective Investment Scheme (CIS) or Mutual funds in the capital market will hit N1.5 trillion before the end of the year.

CIS also known as Mutual Funds is an arranged pool of funds managed on behalf of investors by a professional money manager which may invest in; ventures capital, portfolio of stocks Bonds and other securities.

Ms Mary Uduk, acting Director-General SEC, stated this over the weekend at the Capital Market Correspondents Association of Nigeria (CAMCAN) forum sponsored by the commission in Lagos.

Uduk said the commission was setting up more strategies to develop the mutual fund segment in the Nigerian capital Market.

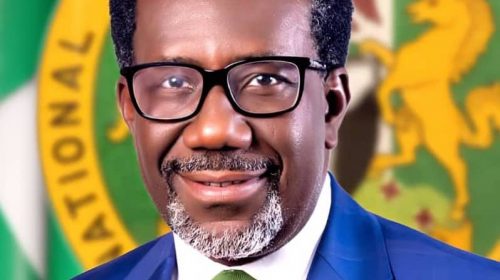

Uduk who was represented by the Head, Office of Economics at SEC, Mr Okey Umeano, noted that the segment which currently stands at N1.2 trillion is growing and urged retail investors to use the funds as a means to access the market.

“In any advanced market, the Collective Investment Scheme form a very big part of the market.

“We at the commission have discovered that some of the investors who lost their savings during the crisis in 2008 are low on confidence.

“That is the reason why we are encouraging retail investors to go through these mutual funds because they are set up and approved by capital market operators and the SEC and the SEC regulates them (operators).

“Currently the size of the segment stands at N1 trillion but we expect it to grow much higher.

“So we are urging retail investors and high networth investors to use the mutual funds route to enter the market”, Uduk said.

Corroborating her, Divisonal Head, Economic, Research and Policy Management, SEC, Dr Afolabi Olowookere, noted that the commission expects to see a significant rise of N1.5 trillion or N2 trillion in mutual funds.

Olowookere noted that about 480,000 investors had keyed into that the investment segment.

“We still expect that size to get to N1.5 or N2 trillion and the reason is because it provides an avenue for retail investors to buy.

“The mutual fund may not have very high return but definitely it won’t have low return and with the SEC at the forefront of financial inclusion, we are pushing collective investment scheme because it brings some form of stability for investments.

“The number of units of account in that segment currently stands at 480,000 investors and it would likely increase”, he said.

Uduk said domestic investors transactions in January outperformed foreign investors execution by 40 per cent, which accounted for N70.32 billion.

According to her, breakdown of domestic investors transactions show that the domestic institutional transactions accounted for N83.47 billion, while domestic retail transactions stood at N81.67 billion.

Uduk said the trend re-emphasised the need for increase retail investors’ participation in the market.

She stressed the importance of not allowing uncertainties dampen our resolve to attain the strong capital market of the nation’s dream.

“In spite of these trends, clearly, the fundamentals of our markets and economies remain solid and promising as astute investors know.

“I therefore, urge retail investors to leverage on this and invest in the capital market, which is one of the avenues to build sustainable and long-term wealth,” Uduk noted.

She noted that the commission in conjunction with other self-regulatory organisations (SROs) had continued to enhance the regulatory framework through various policy reforms and initiatives to boost investors’ confidence.

“There is therefore the need for increased participation of local (retail and institutional) investors in the market and for foreign investors to have higher confidence concerning the safety of their investments,” she added.

Uduk explained that the 10-year Capital Market Master Plan (CMMP) was developed in 2015 to map out strategies for improvement of the Nigerian Capital market in areas such as investor protection and education, professionalism and product innovation, among others.

She said the commisison this year would drive several market initiatives in a bid to restore investor confidence thereby increasing participation in the market.

She listed the initiatives as deployment of Real Time Automated Market Surveillance System; driving the growth of Collective Investment Schemes (CIS); capital market literacy and completion of the infusion of capital market into schools’ curricula.

Uduk added that SEC would ensure robust engagement with sister agencies like the Central Bank of Nigeria, PENCOM, National Insurance Commission and others to ensure consideration of the capital market in policy making.

She stated that the commission would leverage the success of the e-Dividend initiative to drive Direct Cash Settlement and solve the multiple subscription problem in the market.

“Notwithstanding the numerous initiatives and strategies being implemented, the commission realises that more still needs to be done.

“Our market’s performance is reasonably influenced by activities of foreign investors such that their instantaneous exit poses a challenge.

Leave a Reply