Total Pension Assets Soar To N10.79tn

By Ngozi Onyeakusi– Total pension assets under the Contributory Pension Scheme (CPS) has risen to N10.79tn as of the end of May 2020, despite the challenges of COVID-19 on the economy.

This shows a growth rate of N577.77bn when compared with N10.21tn recorded as at December 31, 2019.

The National Pension Commission (PenCom) disclosed this in its report titled ‘Summary of pension fund assets as at 31 May, 2020.

The statistics showed that the bulk of the funds totalling N7.2tn had been invested in Federal Government’s securities including FGN bonds, treasury bills, sukuk and green bonds. Other investment portfolios where the operators invested the funds are real estate investment trusts, private equity funds, infrastructure funds, cash and other assets.

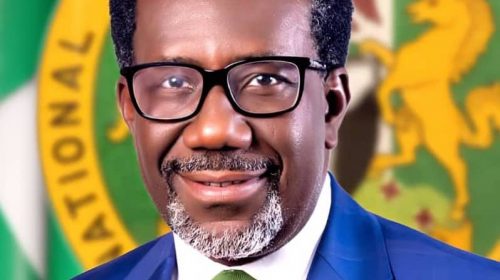

According to the acting Director-General, PenCom, Aisha Dahir-Umar, the scheme was important in the face of contemporary developments in Nigeria’s pension landscape and the Nigerian economy as a whole. She said, “The Contributory Pension Scheme was established to address challenges bedeviling the erstwhile retirement benefit system (Pay As You Go/Defined Benefit) in the public sector and Provident Fund/Nigeria Social Insurance Trust Fund in the private sector.” The pioneer Director-General, National Pension Commission, Mr Muhammad Ahmad, had in a recent forum said there was a need to encourage the development of enabling framework for pension funds to facilitate national development.

Leave a Reply